I-System Trend Following offers superbly engineered turn-key portfolio solutions and the ultimate quality decision support for investors and traders. Our daily TrendCompass reports cover more than 200 financial and commodity markets – effectively and with utmost reliability since 2003.

Trends are the most powerful drivers of investment performance and trend following is the most reliable way to navigate trends profitably in multiple financial and commodity markets.

I-System: probably the best trend following model ever built

This is not a hollow claim (click here to see why). We have a nearly 20-year continuity of using the I-System and an audited track record to support it.

What is the I-System?

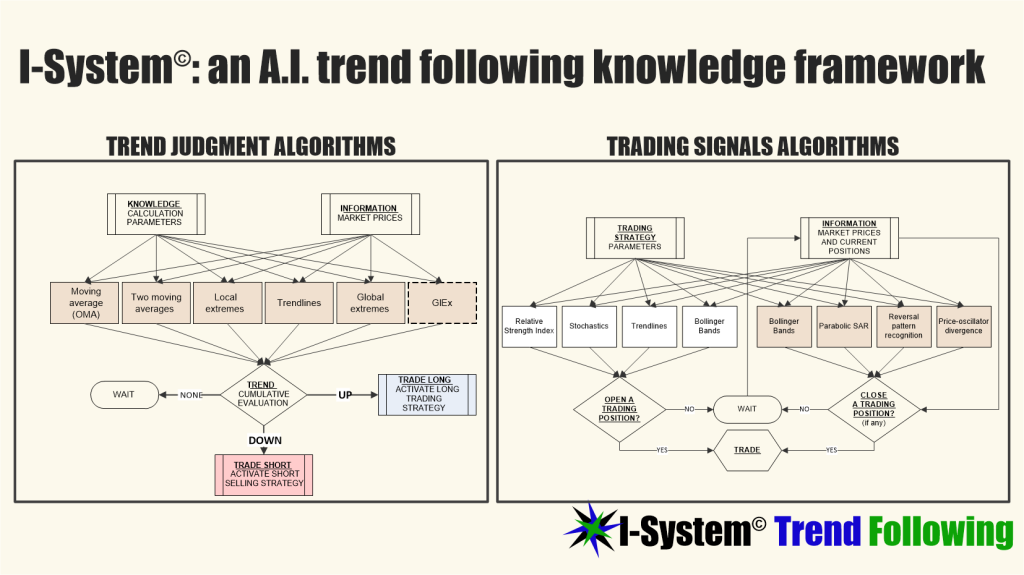

I-System comprises a dual neural network of mathematical algorithms that codify a body of knowledge in market analysis and trading.

This robust architecture enables I-System to track thousands of intelligent trading strategies in any security market, generating consistent trading signals with zero loss of quality or focus. Its versatility enables the I-System to simultaneously track long-, short-, and medium-term trends and deploy multiple strategies in any market. This in turn dramatically reduces the model risk often associated with other quantitative models.

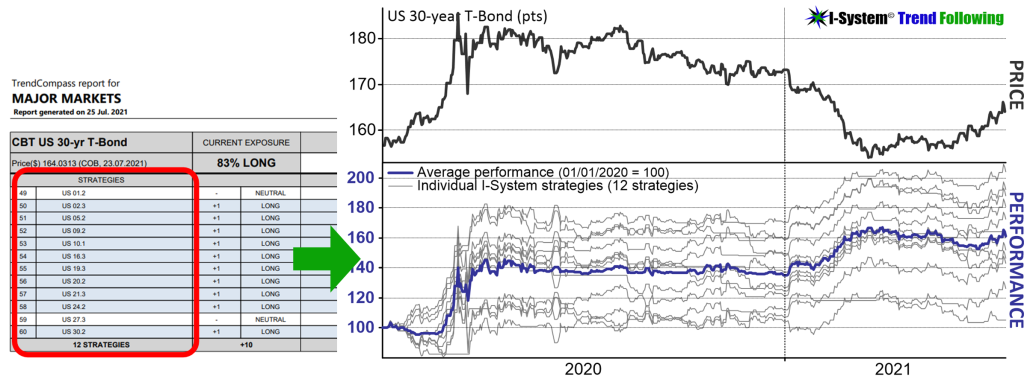

An army of 12 traders… (or however many)

Perhaps the best way to grasp this is metaphorically: suppose you set aside a $12,000 risk budget to trade the US 30-year T-Bond futures. Rather than turning the sum over to one trader, you allocate $1,000 to 12 different traders. Instead of one trader buying and selling 12 contracts, you get 12 of them trading 1 contract each (you can use more or fewer traders; in the past I’ve used as many as 32 strategies in a single market).

All your traders studied their craft at the same school of thought, but each looks at the market in a slightly different way: some focus on short-cycle trends, others at medium- or long-cycle trends; some keep their positions open most of the time, others wait longer for the right signals and take their profits or cut losses quicker. You know that some of your traders will do very well and others less so, but in fragmenting your risks among a number of them, you can be confident that as a group they will do well, even if a few of them underperform.

An effective and reliable trends auto-pilot

Over the years, it has proven supremely reliable as well as effective: since 2003 it has functioned continuously with zero code tinkering, alterations, interruptions or maintenance issues. Since the start of our track record in 2007 it has consistently outperformed the relevant strategy benchmarks, including world’s top ranked, Blue Chip Commodity Trading Advisors (CTAs). Below is the most recent summary of our Major Markets portfolio (click here for the detailed PDF report).

These are the results of actual trading signals generated and communicated to our subscribers in the real time (not a backtest simulation). And here’s how I-System strategies navigated the U.S. Treasury market moves in July 2021, which have left most traders and analysts “dazed and confused” and caused multi-billion losses among the most pedigreed hedge funds:

In all, I-System has been a thoroughly consistent performer since 2003, never once failing to capture substantial profits from large-scale price events in global markets. You can read more about its performance on this page.

This same quality of decision support is now available by subscription to one or more of our daily TrendCompass reports (see the above link for more details), but our solutions equally include superbly engineered turnkey portfolio solutions and price risk solutions for firms with substantial exposure to commodity, FX or interest rate risk.

To listen to my talk on Trend Following with bestselling author Michael Covel, follow this link: https://www.trendfollowing.com/2021/05/27/ep-975-alex-krainer-interview-michael-covel-trend-following-radio/

Jack Schwager, who knows a few things about trading and investing, thought it was great!

In fact… everything we do we do with an uncompromising devotion to quality, reliability and effectiveness.

I-System solutions: reliable, versatile, effective.

Get top notch trends guidance on key financial and commodity markets – in seconds, not minutes a day. The first month is on us.

From diversified trend following to dynamic portfolio allocation, we offer a variety of high quality portfolio solutions

Unlock profit potential and hard-to-duplicate competitive advantage with our commodity, FX hedging solutions

Sign up for a 1-month free trial of I-System TrendCompass!

One of the best trend following newsletters on the market, I-System TrendCompass delivers consistent, dependable and effective decision support daily, based on I-System trend following strategies covering over 200 key financial and commodities markets with no dilution in quality or focus.

- Cut the information overload

- Get real-time CTA intelligence in seconds per day

- Never miss a major trend move

- Navigate trends profitably, with confidence and peace of mind

One month test-drive is always on us. Sign up for a 1-month FREE trial by e-mailing us at TrendCompass@ISystem-TF.com

To learn more, please visit I-System TrendCompass page.